When you are wondering what Anti-dumping duty is, you first need to understand what dumping is.

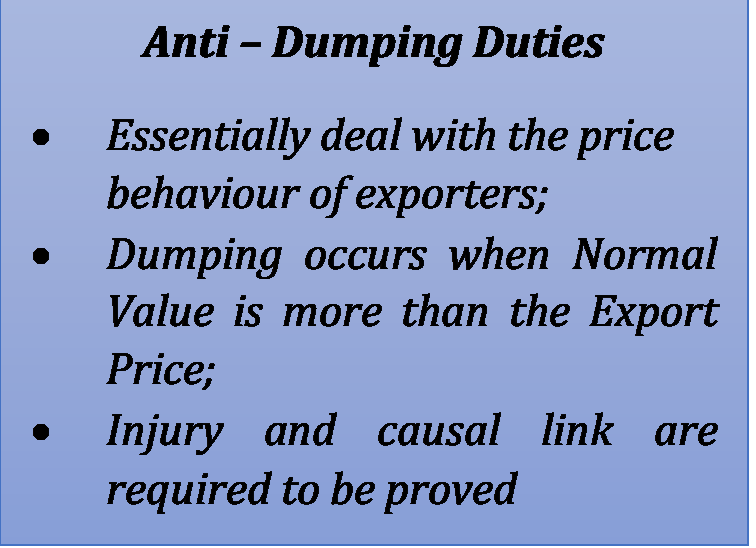

Dumping refers to the export of a large number of products by exporters from one country or region to the market of another country or region at a price lower than their normal value, in order to achieve the purpose of crowding out competitors, occupying market share, and obtaining undue profits.

Dumping can cause damage or threat to the producers and industries of the same or similar products in the importing country, affecting their normal operation and development.

Definition of Anti-dumping duty

Anti-dumping duty refers to a kind of additional tariff imposed on dumped products in addition to the normal tariff by the government of the importing country in order to protect the domestic industry from the adverse effects of dumping in accordance with the rules of the World Trade Organization (WTO).

The anti-dumping duty is borne by the importing operator.

Purpose of Anti-Dumping Duty:The purpose of anti-dumping duty is to eliminate or mitigate the damage caused by dumping, to restore fair competition in the market, and to safeguard national interests and trade order.

There are more knowledges about Anti-dumping in this article:

Calculation of Anti-dumping duty

The calculation method of anti-dumping duty is: anti-dumping duty rate = (normal value – export price)/export price × 100%.

Among them, the normal value refers to the comparable price of similar products in the market of the exporting country or region, or in the absence of comparable prices, based on the comparable price of exports to a third country or region or the country or region of origin constitutes the price of the projection. The export price is the price at which the imported product is actually traded at the border of the importing country.

The anti-dumping duty rate may not be higher than the dumping margin, i.e. the difference between the normal value and the export price.

If you don’t want to just read these text interpretations, you can click on the video below to help you understand more quickly about the FBA Anti-dumping duty:

Is there a way to reasonably avoid Anti-dumping duty?

Re-export Trade

How to avoid anti-dumping through re-export trade? First of all, you need to find a suitable re-export country. Factors to consider when choosing a re-exporting country include tariff agreements with the country of origin, policy stability and the degree of government regulation.

At the same time, it is also necessary to understand the needs of the target market and potential competitors in order to develop appropriate marketing strategies.

Optimize Product Flow

Optimizing product flow is key. Through reasonable production and processing processes, to achieve a certain degree of modification or packaging in the re-export countries, so as to change the origin of goods, and further avoid anti-dumping. It should be noted that this process should comply with the requirements of trade regulations of each country to ensure the legality.

Establishment of stable and reliable cooperative relations

It is also important to establish a stable and reliable cooperative relationship. You can consider cooperating with some professional trade service organizations or rely on local enterprises in the re-exporting countries to provide support and assistance. This can not only effectively solve some operational and quality problems, but also provide more resources and information to help you better avoid anti-dumping.

Anti-dumping duty collection regulations

The decision to impose

If all the elements for the imposition of anti-dumping duties have been met, the decision as to whether anti-dumping duties are to be imposed and whether the amount to be imposed is equal to the dumping margin or below the dumping margin is made by the authorities of the importing country.

If the injury to the domestic industry can be fully eliminated below the dumping margin, then the amount of anti-dumping duty levied is preferably lower than the dumping margin;

The object of the levy

The imposition of anti-dumping duties should not be discriminatory, and anti-dumping duties should be imposed on all imports found to be dumped. The amount of levy should be a suitable share for each exporter;

Basic price system

The basic price system means that under normal competitive conditions, the difference between the “basic price” and the output price is determined by a range that does not exceed the lowest normal price in the exporting country and is used as the amount of the anti-dumping duty to be levied.

Xiongda International Logistics is a freight forwarding company specializing in shipping from shipping from China to USA. We do not undertake any anti-dumping products to ensure the safe passage of customs inspection.