In DDP,the seller is responsible for transporting the goods from the place of shipment to the designated destination within the importing country as stipulated in the contract and physically handing over the goods to the buyer before the delivery is considered complete.How much does DDP shipping cost to USA?

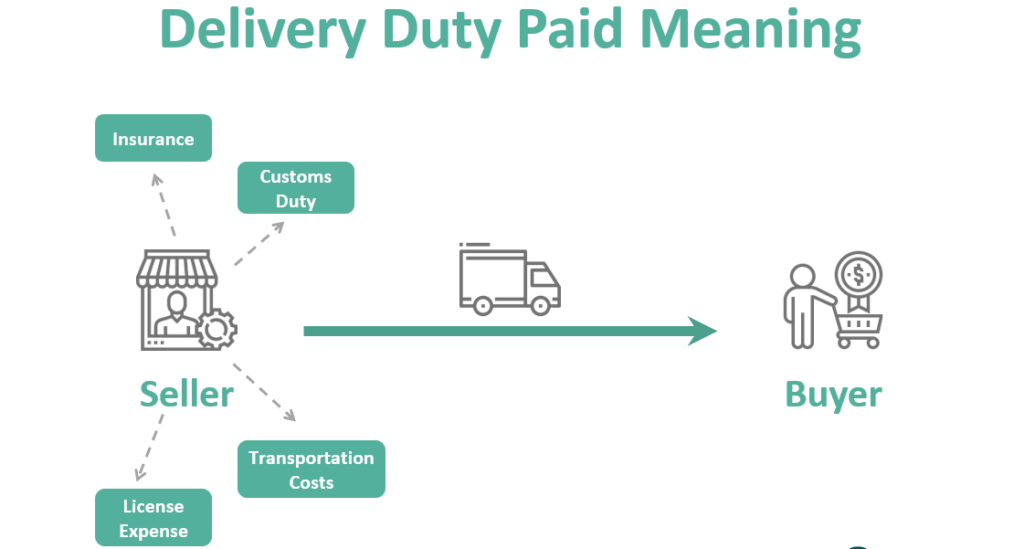

DDP Cost Bearer

The seller must bear all risks and costs of transportation of the goods to the named place of destination, including any duties and taxes payable at the place of destination if customs formalities are required, including the responsibility and risk of customs formalities, as well as the payment of handling, customs duties and other charges.

DDP Shipping Charges to USA

The DDP trade term means that the seller delivers the goods to the buyer with all costs included, including transportation, insurance, duties, taxes, and so on.

Therefore, the cost of DDP sea delivery to the United States includes the following aspects:

Transportation cost

Including the cost of sea, air or land transportation, depending on the volume and weight of the goods, the mode of transportation and the starting and ending points.

Tariffs and taxes

According to the U.S. Customs regulations, imported goods need to pay tariffs and taxes, the specific rate depends on the type and value of the goods.

Insurance cost

In order to protect the safety of the goods in the process of transportation, it is necessary to purchase cargo transportation insurance, and the insurance cost depends on the value of the goods and the mode of transportation.

Other costs

Such as loading and unloading fees, storage fees, customs clearance fees and so on.

How Much Does DDP Shipping Cost

How much does DDP shipping cost to USA?

Step 1: Calculate the FOB (Free On Board) price of the exported goods, including the commodity price and freight.

FOB Price = Commodity Price + Freight Charges

Step 2: Calculate the tariffs and taxes for the exported merchandise based on the tariff policies of the exporting and importing countries.

Tariffs and duties = FOB price x tariff rate

Step 3: Calculate the CIF price (i.e., Cost-In-Transit) of the exported goods, including FOB price, insurance and freight.

CIF Price = FOB Price + Insurance + Freight Rate

Step 4: Calculate the VAT on the exported goods according to the U.S. VAT policy.

VAT = CIF price x VAT rate

Step 5: Calculate the US DDP price for Duty Paid to Door.

DDP Price = CIF Price + Duties and Taxes + VAT

How Much Does DDP Shipping Cost

How much does DDP shipping cost to USA | Example:

If the FOB price of the exported goods is $10,000, the freight cost is $500, the insurance cost is $100, the tariff rate is 5%, and the VAT rate is 10%, the calculated DDP price is:

FOB price = 10000 USD + 500 USD = 10500 USD

Tariffs and taxes = $10,500 x 5% = $525

CIF price = 10500 USD + 100 USD + 500 USD = 10600 USD

VAT = 10600 USD x 10% = 1060 USD

DDP price = $10600 + $525 + $1060 = $12,285

We specialize in ship from China to the US, and can provide sea freight from China to USA,air freight from China to USA.

Why Is DDP Shipping To The US Is A Good Idea For The Seller?-Xiongda