Both DDU shipping and DDP shipping are international trade terms used to stipulate the responsibilities and obligations of buyers and sellers during the delivery of goods. They differ in the place of delivery:

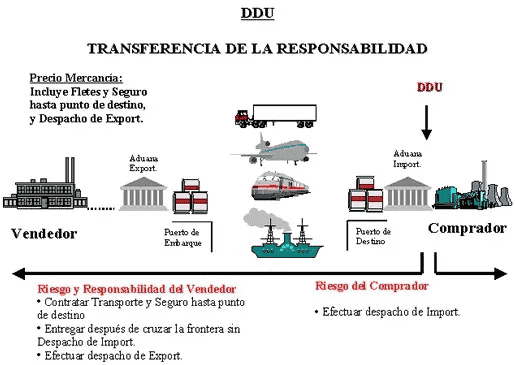

DDU (Delivered Duty Unpaid)

The seller is responsible for delivering the goods to the destination and bears all costs, excluding import duties and other taxes in the destination country. It is the buyer’s responsibility to handle and pay for all related import procedures and fees.

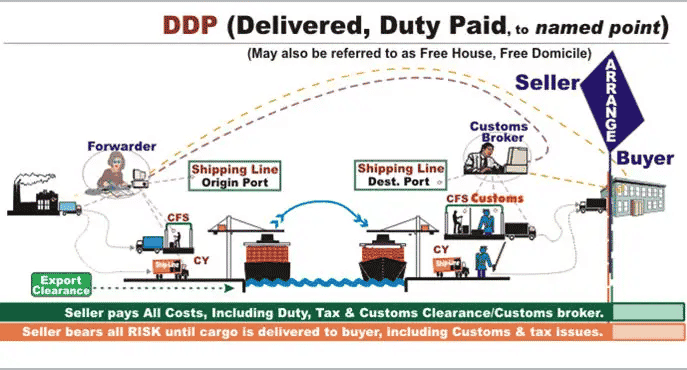

DDP (Delivered Duty Paid)

The seller is responsible for delivering the goods to the destination and bears all costs, including import duties and other taxes in the destination country. The buyer does not need to pay any additional fees.

Relevant regulations of DDU shipping

The seller must bear all the costs and risks of transporting the goods to the designated destination, except for import procedures and customs duties. The seller must bear all costs except import procedures and customs duties for the delivery of the goods to the designated destination, including: freight, insurance premiums, export taxes and related costs + appropriate profits + production costs.

Relevant regulations of DDP shipping from China to USA

The seller must bear all risks and costs of transporting the goods to the named destination, including any “taxes” payable at the destination when customs formalities are required (including the responsibility and risk of customs formalities, and the payment of handling charges, duties, taxes and other charges).

The difference between DDU and DDP

Different delivery methods

DDU is the delivery duty unpaid at the port of destination, and the goods are handed over to the buyer at the designated destination; DDP is the delivery duty paid at the port of destination, which means that the seller has completed the import customs clearance procedures at the designated destination, and will deliver the goods in the delivery vehicle. The unloaded goods are handed over to the buyer.

The import declaration is different

DDU shipping means that the seller handles the import declaration and bears the cost before delivery; DDP means that the buyer handles the import declaration, assumes the responsibility and risk of handling customs procedures, and pays handling fees, duties, taxes and other fees.

DDU shipping vs. DDP shipping:How To Choose?

The choice of DDP or DDU mainly depends on the transaction needs and actual situation of both parties, and needs to be considered comprehensively according to the specific situation. Here are some factors to choose DDP or DDU:

Importing country legal and regulatory requirements

If the importing country has stricter legal and regulatory requirements, then DDP may be a better choice, because the seller will be responsible for handling all import procedures and paying all duties and taxes, avoiding the buyer’s unfamiliarity with legal and regulatory requirements. the problem we are facing.

Actual capabilities of buyers and sellers

If the seller has the actual ability to handle import formalities and pay duties and taxes, then DDP may be a better choice. If the seller does not have such practical capabilities, or the buyer is more adept at handling these matters, then a DDU may be more appropriate.

Cargo type and mode of transport

Different cargo types and transportation methods may have an impact on the selection of DDP and DDU. For example, for goods that are fragile or have special requirements, the seller may prefer to choose DDP to ensure that the goods are better protected during transportation.

In general, whether to choose DDP or DDU needs to be considered comprehensively according to the specific situation, and the final decision should be made on the basis of negotiation between the two parties. At the same time, both parties should clearly stipulate the delivery terms in the contract to avoid disputes caused by misunderstanding or inconsistency.