Import and Export Declaration is one of the necessary links to perform customs entry and exit procedures, involving objects including: inbound and outbound means of transport and goods, goods in two categories. Due to the different nature, the procedures of customs declaration are also somewhat different.

Export declaration – required materials

- Commercial invoice: It contains information such as description, quantity, price and weight of goods.

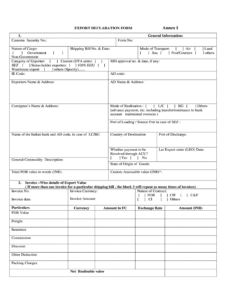

- Customs declaration: It is the main document for customs audit and statistical information of goods, including information of name, quantity, value, weight, origin, etc. of goods.

- Contract: detailing the terms and conditions of the buyer and seller, including the quantity, price, delivery date and other information of the goods.

- Packing list: detailing the packing of the goods, including the box number, quantity, weight and other information.

- Other product-related documents: such as commodity inspection, license, etc.

The main types of documents for Export Declaration

Import goods declaration

Export goods declaration

Import and export declaration inspection of goods

Check the customs inspection can be divided into three types: thorough inspection, spot checks and external inspection. Customs inspection since the acceptance, to the end of the implementation of inspection, feedback inspection results will not exceed 48 hours.

Customs inspection of goods there are 3 requirements

- The consignee or consignor of the goods or their agents must be present, and according to the requirements of the Customs responsible for handling the removal of goods, unpacking and resealing the packaging of goods;

- The Customs and Excise Department that, if necessary, can be opened, re-inspected or extracted samples of goods, cargo management personnel should be present as witnesses;

- The applicant should provide round-trip transportation and accommodation, and pay the relevant fees, and pay the fees according to the customs regulations.

Import declaration process

- Preparation of customs declaration information (contract, invoice, packing list, bill of lading);

- Fill out a handwritten draft customs declaration form. Filling a draft customs declaration form according to the declaration information;

- Printing the customs declaration review form. Entry of data on the QP system by the customs broker according to the draft form and printing of the customs declaration review form;

- Sending data. The operator sends the declaration data to the electronic port using the declarant card;

- Receiving data acknowledgement;

- Printing out the customs declaration;

- On-site delivery of declarations;

- Auditing of declarations;

- Tax collection;

- Tax payment. Enterprises pay taxes to the designated bank account according to the tax bill, and the bank stamps the receipt stamp on the tax bill;

- Tax bill write-off;

- Selection of inspection. Armed with manual control – on-site customs choose whether to check the goods according to the risk value of the goods (if it is computerized, then the goods must be checked);

- Release;

- Withdrawal of the goods after customs release;

- Completion. The customs broker can print the proof of import payment.

Export declaration process

- Signing the contract. The exporter signs an export contract with the foreigner to determine the goods to be exported;

- Contacting freight forwarder. The exporter contacts the transportation company;

- Booking shipping. Freight forwarder responsible for arranging trailer, booking, customs clearance and shipment according to exporter’s requirements;

- Preparing information;

- Formal declaration.

Export declaration is complicated for non-professionals, so it is better to find a freight forwarding company that can help you to act as a customs agent, such as Xiongda International Logistics.

For all your needs for shipping from China to USA,please contact us today! We are also your Amazon FBA freight forwarder worth considering.