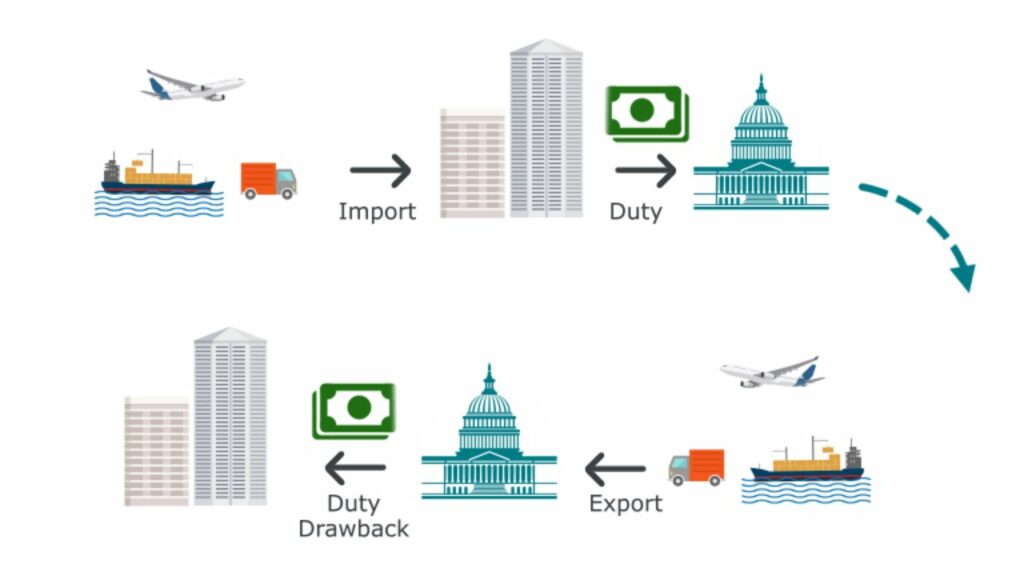

Export Duty drawback refers to the refund of value-added tax (VAT) and consumption tax (CST) paid in accordance with the tax law at all stages of domestic production and circulation for goods declared for export by China in international trade business, i.e., tax exemption at the export stage and refund of tax paid at the previous tax stage.

As a common international practice, export tax refund can make the overall tax burden of exported goods zero and effectively avoid international double taxation.

If you want to know more details about Export Duty drawback, you can click on this article:

Export Duty drawback conditions

- The export tax rebate enterprise must have the qualification of general VAT taxpayer.

- After a series of import and export procedures, obtaining import and export rights.

- Completing the procedures of export tax rebate and completing the declaration of export tax rebate.

- The goods of export tax rebate enterprises are exported goods and goods within the scope of VAT export tax rebate.

- The export tax refund enterprise exports goods and issues special invoices for VAT input tax certified by tax authorities.

- Even if the export tax refund business is declared, it must be examined by the tax authorities, and if the examination is unqualified, no tax exemption will be established.

- Reconciliation and liquidation must be completed before export tax refund.

Even if the export enterprise has applied for export tax rebate and meets the above conditions, if the foreign trade enterprise applies for export tax rebate for the first time, the tax bureau will come to the door to review.

Basic Policy of Export Duty drawback

Export tax exemption and Export Duty drawback. It is the tax exemption for the export sales link, and the input tax refund for the procurement link before export, i.e., zero tax rate for exported goods, and the state follows the basic principle of “how much to levy and how much to refund” and “no levy, no refund, no complete tax refund”.

Export tax exemption but no tax refund policy (only exemption, not refund). It means that the export sales are exempted from VAT, but the input tax of the purchase is no longer refundable.

If you don’t want to just read these text interpretations, you can click on the video below to help you understand more quickly about the Export Duty drawback:

Operation process of export Duty drawback

1. First get the write-off order online, log on to the system, enter the system, select the export collection, and then finally select the write-off order claim.

2. After receiving the bill of sale, in accordance with the above operation claimed the electronic port IC card, as well as the above letter of introduction, after receiving these two things, you can go to the foreign exchange bureau to receive.

3. The next step is the most important step is to stop the write-offs for the record, in accordance with the above instructions to log on to the system to select the export collection, and then finally select the port for the record.

4. Customs clearance procedures

- You can find a freight forwarder, and then inform the final location of this export, weight and time, they will give a quote according to the company.

- The export of goods this time to prepare a power of attorney stamped to the freight forwarder.

- Do the packing with the forwarder, and dock with them what time to leave the ship.

- All the relevant information must be reported to the freight forwarder.

- Freight forwarder to declare customs.

- In the original scheduled time for crating, to fill out the packing list.

- Generally, the shipment will leave the ship after 2~3 days of packing.

- Within 2~3 days after the shipment, the forwarder will pass the bill of lading to the company.

40 days after the customs declaration, the freight forwarder will send the company customs declaration information.

Attention! Export Duty drawback to meet four conditions:

- Taxable goods

- Goods leaving the country

- Confirmed sales

- Foreign exchange collection and write-off completed

Focus on shipping from China to USA for 16 years.

We provide variable plans for air and sea freight from China to USA.

Xiongda can has cooperations with shipping comany, you will get better shipping price.