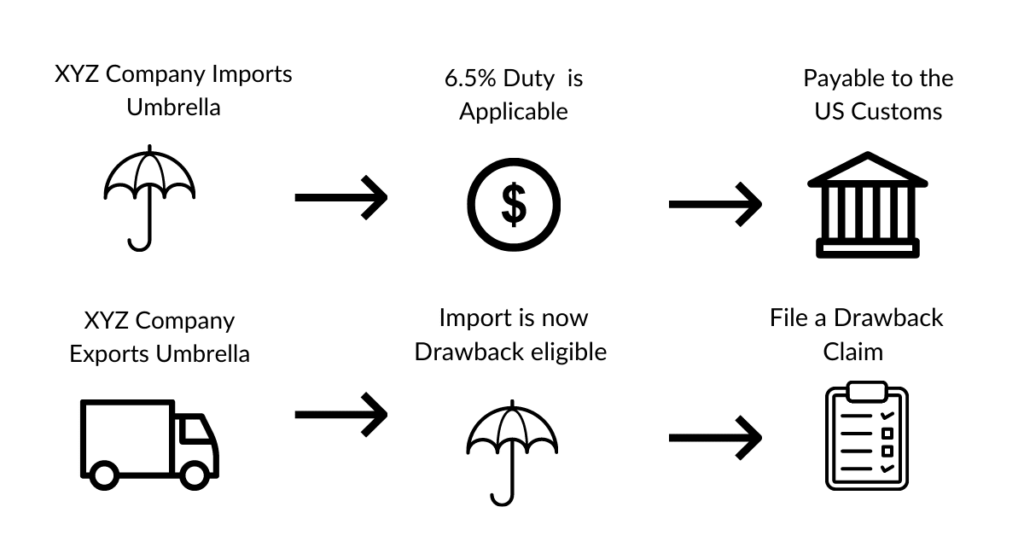

Import and export trade Duty Drawback refers to the application to the customs for a refund of the paid import tax after the imported goods have been taxed by import duties and value-added tax;According to the unified tax rate and amount, the export enterprise declares to the customs the return of the paid value-added tax and consumption tax on products sold overseas.

Purpose of Duty Drawback Policy

- The purpose of the tax rebate policy is to promote foreign trade;

- Encourage export enterprises to explore the global market;

- Reduce corporate tax burden

- Improve the product competitiveness of the enterprise

- Control the price of export products

- Enhance the competitiveness of enterprises in the international market.

Implementation of Duty Drawback policy

The tax rebate policy is mainly a policy of refunding value-added tax, consumption tax, tariffs and other taxes collected in advance for foreign trade export commodities.

There are two ways to implement tax refunds: centralized tax refunds and decentralized tax refunds.

Centralized tax rebates are collected by the tax authorities for tax refunds;

In decentralized tax rebate, the export enterprise will directly refund the tax to the tax authority.

Applicable scope of Duty Drawback policy

The tax rebate policy is usually applicable to commodity export enterprises, and the policy scope of many countries is gradually advancing to services, technology exports and other fields.

At the same time, the scope of application of the policy is also subject to the influence of international trade links such as national policies and trade rules.

Application conditions of the Duty Drawback policy

In order to avoid some companies spending money to buy unqualified products and then export them to obtain tax refunds, imported goods need to meet customs regulations, and export companies need to meet the following conditions:

- Enterprises need to operate in a standardized manner in terms of finance, taxation and market management;

- The quality of export products meets the requirements of customs regulations;

- Export goods and services are within the scope of international foreign exchange management and other national laws and regulations.

Advantages of Duty Drawback Policy

The tax rebate policy reduces costs for enterprises, enhances the competitive advantage of exports, and improves the core competitiveness of enterprises.

The tax rebate policy also encourages enterprises to improve production quality and technical level, which is conducive to promoting economic development and promoting international trade;

For the country’s overall economy, the tax rebate policy is also conducive to promoting exports, attracting foreign investment, expanding opening up, and increasing investment in fixed assets.

We specialize in shipping from China to USA, and can provide sea freight from China to USA,air freight to USA.

As an Amazon FBA freight forwarder company, we are very familiar with Amazon’s relevant regulations. If you need a freight forwarder China to USA , contact us now!