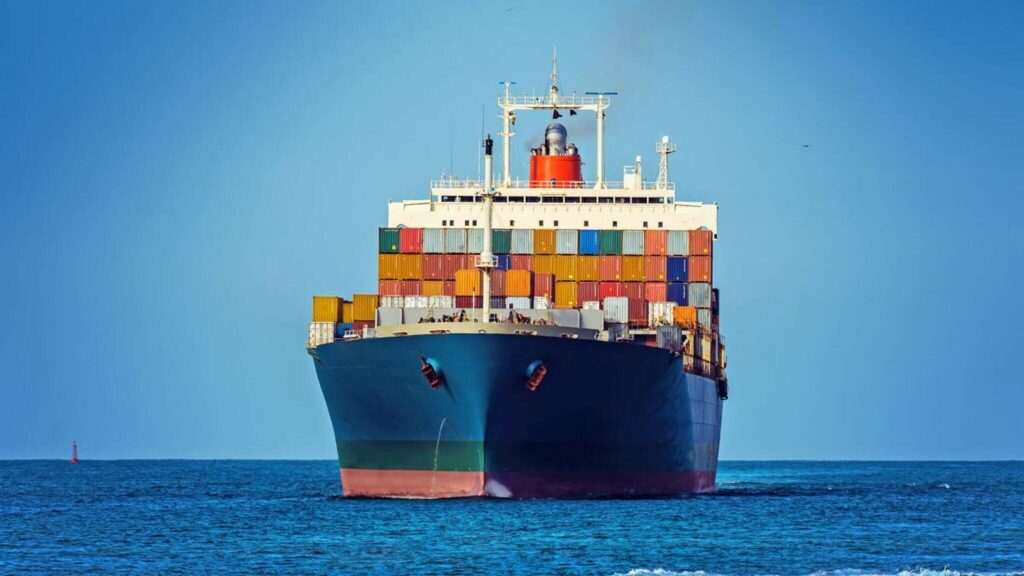

Recently, the Red Sea situation continues to deteriorate, to the global shipping industry has brought no small impact, the U.S. East international shipping prices increase 110%!

Container shipping prices increase to $7,500

Prior to the European route of the ship is still in the detour, the ship with the container are not back to Asia, is expected from January 15 to ship from Asia to Europe, the owner of each 40-foot container to pay at least $ 6,000 dollars.

Not only tariffs continue to soar, with the shipping company bypassing the container shortage, a freight forwarder said that the first half of January, the cabin has been burst, the second half of January offer is only individual shipping companies have updated. It is expected that the shortage of containers in mid to late January will be more serious.

Taking the large ship schedule of the European route in Shenzhen Yantian port as an example, there are empty classes on January 8th, January 15th, January 17th, January 18th, January 22nd and January 25th.

shipping prices increase

Vessels are bypassing the Cape of Good Hope causing delays in timeliness, and capacity shortages will also continue in the coming weeks. Some freight forwarders expect that after January 15, ocean freight prices will continue to rise sharply, according to updated quotes, small containers up about $600, large containers up about $1,000, overall in the range of $500 to $1,000 increase. At the same time the cabin space is tight, container shortage will be more serious.

Because of the fear of risk, many foreign trade enterprises to consider suspending shipments, a foreign trade company has nearly 20 containers suspended shipments, but the current price of shipping continues to rise, which will inevitably impact on the profits of many companies.

Shipping prices increase losses must be borne by the company. There are shippers four containers from China to Morocco, now the offer and the beginning of last December difference of more than 100,000 yuan. A forwarder feedback, before sending a container price is 2300 dollars -2400 dollars, now a conservative estimate of 6500 dollars or so.

Affected by the Red Sea crisis, the demand for China-EU trains has risen further, and the price has also risen.

Due to the delay in the time limit, coupled with the substantial increase in freight, resulting in many customers who originally chose sea transportation began to consider the China-EU liner. It is understood that since the Red Sea crisis, CEVA’s Sino-European land cargo volume has increased by about 30%.

shipping prices increase

Some practitioners said that as much as 30% of the goods arriving on the east coast of the United States need to pass through the Suez Canal, and logistics executives believe that some of the goods will be shifted to the west coast of the United States.

According to the latest data from the Shanghai Shipping Exchange, the SCFI for this period was 1896.65 points, up 7.8% from the previous period. Shanghai to the U.S. East route shipping prices increase 10.45%, and to the U.S. West route shipping prices increase 8.7%.

With the arrival of China’s peak shipping season before the Chinese New Year, from January 15, Asia to North America freight rates will rise, according to industry insiders, Asia to the U.S. West per 40-foot container of $ 5200, or 103%; U.S. East per 40-foot container of $ 7500, or 110%.

According to Freightos, in addition to higher container freight rates, there will be a surcharge of $500 to $2,700, which could make all-inclusive prices higher.

For the trans-Pacific route from China to the U.S., the continuing Red Sea situation may cause shipping lines to abandon the Suez Canal and return to the Panama route.

shipping prices increase

In the Panama Canal, container ships have priority of passage, but there are still waits and minor delays. In addition, forwarders and cargo owners need to pay attention to the space situation of the U.S. East route.