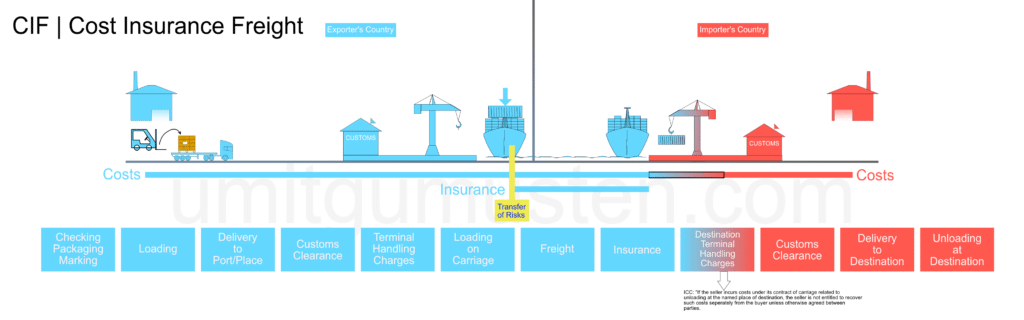

CIF clearance, you must deliver the goods safely to the port designated by the other party, you can enjoy the above rights. The seller has to bear the cost in between.

How to calculate CIF clearance tax exemption and credit?

For goods declared at CIF, the following formula should be used for calculating tax exemption and tax credit: tax exemption and tax credit = (transaction amount – shipping costs – insurance costs – foreign banks and other deductions) x tax rebate rate.

CIF clearance

The three clauses have no practical significance when encountering container transportation or ro-ro ship transportation.

- FOB terms can be changed to FCA(freecarrier).

- CFR can be changed to CPT(cost&freight paid to destination point).

- CIF terms can be changed to CIP(costinsurence freight paid to destination point)

If you want to know more about CFR,you can click this article:

The three terms of export customs clearance are borne by the seller, import customs clearance are borne by the buyer.

In accordance with the customary practice of the international insurance market, the amount of insurance for export goods is generally calculated in accordance with the CIF clearance price of goods plus 10%, which increased by 10% called the insurance rate or insurance rate, that is, the buyer to carry out this transaction paid the costs and expected profits.

The formula for calculating the amount of insurance is: insurance amount = CIF clearance price * (1 + insurance rate) CIF clearance for the calculation of the amount of insurance, indicating that not only the goods themselves, but also including freight and insurance premiums as the subject matter of the insurance, and the loss is compensated.

Therefore, for the CFR / FOB contract under the goods insured, you need to report the CFR / FOB price of goods at home to calculate the amount of insurance, the formula is as follows: will be converted from the CFR price to the CIF price: CIF = CFR / [1 – (1 + markup rate) * the sum of the rate of the premium], will be converted from the FOB price to the CIF price: CIF = (FOB + F) / [1 – (1 + markup rate) * the sum of the rate of premium], will be converted from the FOB price to the CIF price: CIF = (FOB + F) / [1 – (1 + markup rate) * the rate of the premium Sum of premium rate].

CFI clearance related video;

Commission calculation formula

- Commission-inclusive price = net price + unit commission

- Unit commission = inclusive price × commission rate

- Inclusive price = net price + (inclusive price × commission rate) = net price / (1 – commission rate)

The discount formula

- Discounted actual selling price = original price × (1 – discount rate)

- Discount amount = original price × discount rate

The three trade terms and their commissions between the conversion formula

FOB price conversion to other prices

- CFR = FOB + F

- CFRC = FOB + F / ( 1 – commission rate)

- CIF = FOB + F / ( 1-insurance rate × insurance markup ) (insurance markup = 1 + insurance markup rate)

- CIFC = FOB + F / (1 – insurance premium rate × insured plus – commission rate )

CIF clearance

CFR conversion to other prices

FOB=CFR – F

- CFRC= CFR / (1-commission rate)

- CIF = CFR / (1-insurance rate × insured markup)

- CIFC= CFR / (1-insurance premium rate × insured markup – commission rate)

Convert CFRC price to other prices

- FOB=[ CFRC× (1-commission rate)] – F

- CFR=CFRC× (1-commission rate)

- CIF=[CFRC× (1-Commission Rate)] / (1-Insurance Premium Rate x Insured Plus)

- CIFC= [CFRC× (1-commission rate)] / (1-insurance premium rate×insurance markup-commission rate)

CIF price converted to other prices

- FOB = CIF × (1-insurance rate × insurance markup) – F

- CFR= CIF× (1-insurance rate×insurance markup)

- CFRC= [CIF× (1-insurance rate×insurance markup)] /(1-commission rate)

CIFC price converted to other prices

- FOB= CIFC× (1-insurance rate×insurance markup-commission rate)- F

- CFR= CIFC × (1-insurance premium rate × insurance markup – commission rate)

- CFRC= [CIFC × (1 – premium rate × insured markup – commission rate)] / (1 – commission rate)

CIF clearance

The price accounting formula

Cost accounting formula

- Actual purchase cost = tax-inclusive cost (purchase cost) – export tax rebate amount

- Export tax rebate amount = tax-inclusive cost × export tax rebate rate ÷ (1 + VAT rate)

Freight accounting formula

- General cargo freight; basic freight + surcharge

- Container freight; LCL and general cargo freight rates are calculated as the same as the full container freight = package rate + surcharge

Insurance accounting formula

- Insurance premium = insurance amount × insurance rate

- Insurance amount = CIF price × (1 + insurance rate)

The insurance markup rate is generally 10%, the insurance amount is calculated based on the CIF (CIP) price or invoice amount.

Proft accounting formula

- Sales price = actual cost + profit = actual cost + actual cost × profit margin

- Profit = actual cost × profit margin

For all your needs for China to USA freight shipping, please contact us today!