Amazon offers convenience channels to merchants through FBA and charges them a fee. Although some products of Amazon FBA charge higher fees, merchants should know the details of the platform’s fees and choose the right products to sell, to achieve long-term profit potential.

This article will bring a detailed explanation of Amazon FBA fees for the majority of seller readers, understand the classification of each fee, and provide more platform information.

One of the challenges of being an online seller is shipping orders. As the business grows, merchants will sell more categories and quantities, and shipping can become time-consuming.

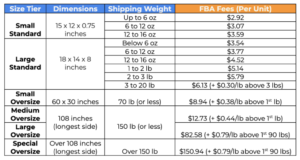

This is another reason why Amazon’s FBA program is so good. In addition to warehousing, Amazon’s FBA helps sellers deliver orders. Sellers can also take advantage of Amazon’s multi-channel logistics plan to ship orders from their standalone sites and other third-party channels. Fees are based on weight, and as the weight of an item increases, so does the cost.

Amazon will raise logistics fees on all its products from January 18, 2022. Medium – and extra-large categories are expected to be significantly affected.

Logistics Costs

Small, large, and oversize items will see an average net increase of $0.20 per item. Amazon charges $0.50 to $12 more for larger items. Merchants were especially concerned about the medium – and extra-large products, which rose 0.05 cents per pound. That may seem like a modest increase, but depending on the actual delivery process, it could also be a significant expense for the seller.

Suggestions for reducing logistics costs

●Avoid transporting large and dangerous goods. Choose small, light, and non-dangerous goods.

●Avoid selling clothing and other clothing, which can cause logistics costs to rise slightly, so avoid these items if possible.

Storage costs

One of the advantages of taking advantage of Amazon’s FBA program is that merchants don’t need to build their warehouses. Many independent third-party sellers themselves do not have enough space to store large quantities of products.

Here is a breakdown of Amazon’s warehousing expenses:

Effective February 1, 2022, Amazon’s storage fees will increase to the following levels:

January-September: $0.83 / cubic foot (standard), $0.53 / cubic foot (Extra large)

October-December: $2.40 / cubic foot (standard), $1.20 / cubic foot (Extra large)

Increased 0.06 cents per cubic foot in the January-September period and was unchanged from October to December

In addition, starting From May 15, 2022, a surcharge will be imposed on expired inventory. Costs include 271-365 days of delivery for $1.50 per cubic foot. The standard rate for 365 days (or more) remains unchanged at $6.90 per cubic foot (or $0.15 per unit).

Suggestions for reducing storage costs

Choose small and light products. Storage costs largely depend on the size of the item, so look for products that are small but still have a good profit margin.

Avoid dangerous goods. Amazon charges more for “hazardous goods”, which include items containing flammable, pressurized, corrosive, and other hazardous substances, such as batteries, hairspray, and pesticides.

October-December Storage beware: Because of the high volume of sales between October and December, storage costs can rise significantly during this time. Therefore, merchants should observe the sales situation of the past year, choose the products with relatively large sales volume, and launch them, rather than risk the golden time, leaving new products in the warehouse to eat into the profit margin.

●To avoid long-term storage on Amazon. The longer you store your items on Amazon, the higher the monthly fee. In addition to those fees, Amazon also charges additional fees for any items that are stored for more than a year. So try to get the product sold. If it’s completely unsold, amazon can take it out of storage, but there’s also a removal fee (also known as a disposal fee).

●To avoid this expense, it is recommended that merchants consider changing the pricing of products to make them more suitable for customers, preferably at cost, rather than waiting to pay Amazon to handle them for you.

Take advantage of the replenishment fee: If consumers return a product for personal reasons (no longer needed, wrong purchase, etc.), merchants can charge them a replenishment fee of 20% of the price of the item. This can help offset storage costs.

Commission

When merchants sell products on the platform, the platform charges a fee, which is essentially a commission for Amazon. In return for letting third-party sellers sell on their site and gain access to a large customer base, they take a small percentage of each order.

The commission rate varies according to the type. To familiarize yourself with the fee structure before choosing a product to sell. Here are some of the more popular commissions:

Books: 15%

Cameras and photography: 8%

Consumer electronics: 8%

Electronic accessories: 15% for sales price below $100, 8% for sales price over $100

Home and Garden: 15%

Kitchen: 15%

Office supplies: 15%

Toys and games: 15%

Beauty: 8 percent for products under $100 and 15 percent for products over $100.

Full commission information is available at Amazon’s Seller Center.

Despite the increase in commissions, Amazon’s services are typically about 30% cheaper than other e-commerce platforms. Amazon announced a change to cut commissions on lawnmowers and snow throwers from 15 percent to 8 percent. The rate change applies only to products that cost more than $500.

Reduce commission expense recommendations

Keep commissions low by choosing the right category to sell. Commission rates range from 6% to 96%.

Amazon devices have high commission rates in addition to warranties, so third-party sellers should avoid using the sales category. Commission fees for gift cards and clothing are also above average.

If you’re looking for a high-volume product with a low commission rate, consider cameras and photos. There are a lot of bestsellers in this category, and you can make a good profit by paying only an 8% commission.

That said, categories with slightly higher commission percentages can also be profitable, such as books, home and garden, and kitchens.

Additional Fees

There are some other Amazon expenses you should keep in mind when starting your own business.

When you do not provide the box content information, there is an FBA manual processing fee. In this case, you should expect the following rates:

January-October: $0.15 per piece

November-December: $0.30 per set

To avoid this extra charge, merchants need to provide data to their local distribution centers.

Amazon also offers inventory placement, which sends all eligible inventory from a merchant to a single receiving center. The service will take the shipment and distribute it to multiple logistics centers, allowing the product to be shipped more widely.

At the same time, sellers should also consider inbound service fees, which are the cost to Amazon’s partner carriers (UPS and FedEx) of shipping a seller’s inventory in the U.S. to Amazon. There is no flat rate for these fees, but they usually average about $0.30 per unit.

Last but not least, remember to pay tax on your amazon revenue promptly.